Some of you might remember a previous blog about how our journey to become a bank all began. Well, I’m happy to let you know that it’s getting very real indeed. We’ve received our banking licence with restrictions from the Bank of England, bringing us closer than ever to creating the first bank built around you, your friends, and the planet.

Without a doubt, it’s been a challenging path with lots of twists and turns. This blog dives into some of the details around what it takes to become a UK bank and our journey so far.

The journey

When our founders Nazim and Tim kicked Kroo off, we had little understanding of just how mammoth a task we’d taken on. We quickly discovered that very few people in the world have actually built a bank from scratch, particularly in the UK. To put things into perspective, a UK banking license is simply one of the highest benchmarks in banking the world over.

No small feat then! As some famous person once said, “people who are crazy enough to think they can change the world are the ones who do”.

A good analogy would be it’s like climbing a mountain. Less like Everest and it’s tallest-peak status, and more like Annapurna, which, while only the tenth-highest peak, is the world’s most challenging climb. The chances of summiting Annapurna are statistically lower than its counterparts. And that’s where our challenge lies.

Because we’re not only building a startup, but it’s a fintech as well. And the UK banking market has ever-tightening controls around getting a banking licence with the boom in new, digital banks. Also, having a debit card programme has its own ups and downs. Add to that Brexit, with a suite of new laws, regulations and upsets, all in the middle of a pandemic that’s created rising unemployment and the worst economic crisis since the Great Depression of the 1930s…

Yup, it’s definitely not been boring 😅

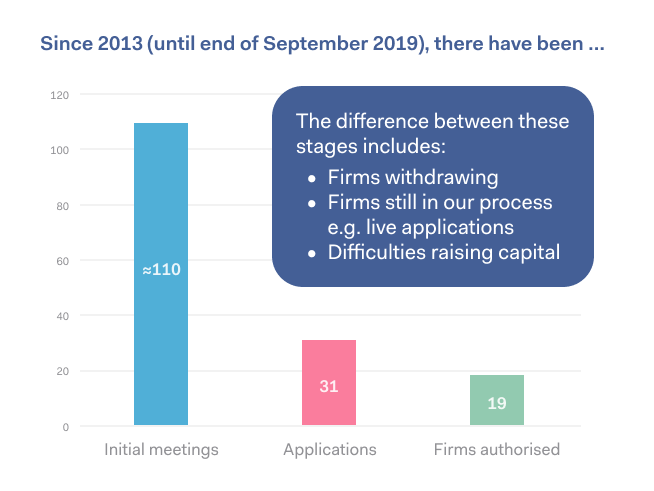

The diagram below is evidence of that. It shows that only a small percentage of banking applications make it past the first hurdle (gulp).

‘If it’s so tough, why even bother?’ I hear you ask. It’s a fair question, one which we’ve asked ourselves on many occasions. Honestly, we did explore other possible routes, but at the end of the day, it was clear the only way a solution such as Kroo was possible would be if it was a bank. Why?

- We want to own the end-to-end customer experience

- We must be a trusted institution if we want people to navigate their entire financial lives with us

- Core to our robust business model and lending strategy is that we must be able to raise deposits that provide FSCS protection

- To have best-in-class digital current accounts in combination with our innovative social tools such as Groups and Pools.

What’s the process?

Working together with the regulators, there are four stages you must pass through before you can become a fully licensed bank.

- Stage 1 — Early stages. Timescale — around 1 year. You need to think long and hard about your proposition and understand if and why you need to become a bank

- Stage 2 — Pre-application. Timescale — 2 years. You need to develop your business model in great detail. Capital and liquidity and your governance structure, as well as a seemingly endless list of policies and procedures

- Stage 3 — Application. Timescale — between 6–12 months. Beginning the build-out of the bank. Raising enough capital. And further developing the banking structure, such as committees, reporting, and other banking deliverables. And let’s not forget about building your Board of directors as well as applying for the Senior Management Functions (SMF)

- Stage 4 — Mobilisation. Timescale — no more than 12 months. You’re a bank but with restrictions. We’ll cover this in a bit more detail later on

- Restrictions lifted — you’re a fully regulated bank, finally!

Who are the regulators?

The Prudential Regulatory Authority (PRA) and Financial Conduct Authority (FCA). In a nutshell, they work together to ensure the safety and soundness of the UK financial system and of their customers.

The PRA is mostly focused on ensuring banks have enough capital and liquidity, the appropriate level of operational resilience as well as a viable plan to be a sustainable bank in the long run. The FCA’s objectives are: to secure an appropriate degree of protection for consumers; to protect and enhance the integrity of the UK financial system; and to promote effective competition in the interests of consumers.

In order to become a bank, you will need to engage with the New Bank Start-up Unit (NBSU), a joint initiative set up by the PRA and FCA. The NBSU gives firms that are interested in applying for authorisation as a bank the information and support they need to set up a bank in the UK.

Where are we?

It’s an exhilarating time for us at Kroo, as everything is coming into focus. We have just entered our mobilisation phase. This is no small feat and we’re extremely proud to be where we are. It’s taken a number of years to put this together and we have crafted 64 documents containing over 2500-pages in total. To do this, the team spent easily a thousand hours of combined effort burning the midnight oil, meeting, drafting, redrafting and drafting again, debating, and brainstorming … and more drafting (no point even trying to count the amount of coffee we drank).

While all of that was happening, we also managed to raise £17.7 million in our Series A funding round, exceeding our £16 million target. We will use most of the funds to propel us through our mobilisation phase, in readiness for our full launch at the beginning of next year. The remaining funds will be held as regulatory capital, in line with the Bank of England’s requirements.

On top of that we are also finalising the build-out of our core banking infrastructure as well as developing the front end. We’re strengthening our governance and ramping up our team size which we hope to almost double over the next nine months, so keep an eye on our career page if you want to join the Kroo family.

What does it mean to be in mobilisation

Firstly, we are a BANK, but with restrictions.

- We have a maximum of 12 months to exit mobilisation. If we fail in any area, everything is reset and the process begins again

- We need to behave and operate as a bank, and therefore, we need to be operational with solid governance in place, i.e. senior management functions and a full board. We will also be required to submit regular progress reports and regulatory reports

- We can test our banking products and refine some elements of our offering

- We will have a cap of £50,000 on the total level of deposits that we can accept

- We will need to raise more funds in series B to exit mobilisation

We’re by no means there yet, but we’ve well and truly set off from base camp, scrambled up to camp one, traversed all the technical pitfalls to camp two and three. We have raised over £30m to date and have a growing team of over 50 people, including some serious banking experts with decades of banking experience. Now, we’re looking up at the summit feeling pumped and ready for the toughest part of the climb. If we make it to the top, we will be joining a small group of the elite when we get our full banking license. Banking license, here we come!

What can our customers expect?

For now, it’s business as usual for your prepaid card. We’re continuing to update our app and make improvements while we work hard in the background to build out the core banking platform, additional current account features, and the overall Kroo experience (for more details on how the money in your prepaid card is protected, take a look at the FAQs on our support page). Once we exit mobilisation, we will gradually close down the prepaid card scheme and offer customers the ability to transition their existing accounts over to our new Kroo current account, free of charge. When it comes to timings, we’ll know more the closer we are to that point. From there onwards, it will be a fabulous, brand-spanking new UK current account with all the same social features that you enjoyed on your Kroo prepaid card, as well as all the bits and pieces you’d expect from a bank and more. Simple!

🚀 We have so much ahead of us, and guess what, we’re hiring! If you’re interested in joining our Kroo head to our careers page https://kroo.com/careers/.